Hello friends, then we will know about insurance like features, customer service, and many other things whose name is Acko Insurance Company.

Acko Car Insurance protects your vehicle without any hassle and protects it from accidents, theft, and various types of damages.

With a completely digital process, zero paperwork, and quick claim settlement, it ensures a seamless experience for car owners.

Acko’s affordable plans and a range of special discounts make quality coverage accessible to all. Trusted by millions, it redefines convenience and reliability in car insurance.

Key Features of Acko Car Car Insurance:

Acko Car Insurance 2025 Review,

Features of Acko Car Insurance:

Acko Car Insurance 2025 Review,

| Features | Coverage And Benefits |

| Network Garages | Yes |

| Claim Settlement Ratio | 99.10% (FY- 2023-24) |

| No claim Bonus(NCB) | Yes |

| Third-Party Coverage | Yes |

| Own Damage Cover | Yes |

| Number of Zero DEP Claims | Yes |

Acko Car Insurance Benefits:

Acko Car Insurance 2025 Review,

1. Incredibly low premium: Whenever you compare the premiums of an Acko insurance company, you will always find that its premium is less than other companies and we have checked its premium many times, then its premium is less than other companies.

2. Zero Paperwork: With Acko Car Insurance, there is no need to fill out physical forms to insure or renew your car policy.

You don’t have to submit a long list of documents either. Everything is online!

Whether you are buying a new car insurance plan or renewing an existing plan, there is no need for any paperwork.

3. Instant Claim Settlement Ratio: Talking about ACKO car insurance, the claim settlement ratio for own damage cover (part of motor insurance) is 99.10%. This data is of 2023-24.

4. Instant Claim Settlement: Acko Car Insurance Company provides you with instant claim settlement

For example, suppose you have a small claim.

Then even through a video call or by making a video and sending it to the company, the company settles it there and transfers the money to your account.

And you can get the work done in any garage which is your non-garage or any authorized service center of the company or the service center of the company whose car you have or from anywhere or if you want to work from outside, you can get the work done from there too.

5. 24×7 Support: Acko car insurance also provides you with 24×7 support. Just like normally all companies provide 24×7 support.

6. Easy Insurance Renewal: You can easily go for car insurance renewal with Acko on the mobile app or website. Just enter your car insurance policy number and proceed with the renewal process to get the policy renewed on time.

Acko Car Insurance is a company that does most of its business online and works very little offline.

| “If you have to purchase any insurance, whenever you fill in your details, you have to enter the details very carefully, such as No Claim Bonus (NCB) and all other details, and after mentioning all the details, you have to proceed or submit only after verifying the complete details.” |

Acko Car Insurance Cashless Garage list?

Acko Car Insurance 2025 Review,

Acko has not mentioned cashless garages on its official website, how many cashless garages it owns, nor has it mentioned the list of cashless garages and how many garages it has.

But Acko Insurance has partnered with select garages to provide seamless cashless repair to its policyholders.

Whenever you visit one of Acko’s exclusive network garages to get your vehicle repaired, you only have to pay the deductible specified in your policy; the rest of the repair cost is paid by Acko directly with the garage.

And when your vehicle is in damaged condition, you can inform Acko through the official, mobile app or customer care. After verification, Acko arranges for a free pick-up of your vehicle within an hour (in select cities) and your vehicle is taken to a cashless garage for repairs. Once the repairs are complete, your vehicle is delivered back to you, making the process very easy.

Although Acko does not publicly provide a detailed list of their network garages, they ensure that your vehicle is taken to the most convenient and suitable partner garage based on the required repairs and your location. This approach is designed to provide you with quick and quality services without having to search for a network garage yourself.

It is important to note that the cashless garage facility is available only with Acko’s comprehensive car insurance plans and does not apply to third-party insurance plans.

Also, services like vehicle pickup and drop-off are available only in select cities. For specific information about the availability of cashless garage services in Indore,

it is advisable to contact Acko customer support directly. They can provide detailed information according to your location and policy.

Acko Car Insurance Claim Settlement Ratio?

Acko Car Insurance 2025 Review,

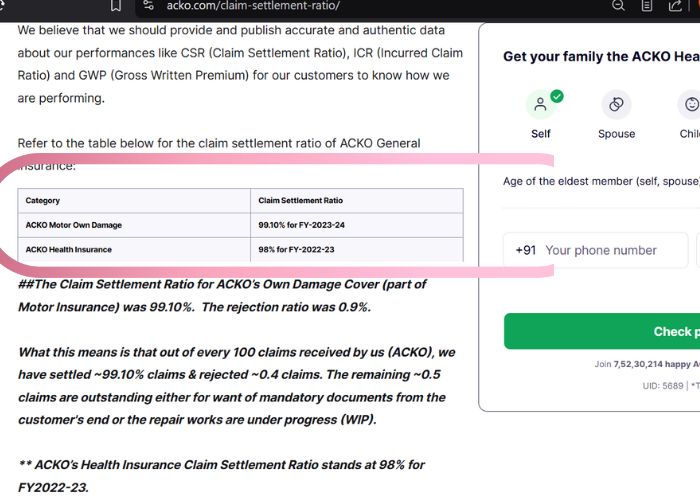

| Category | Claim Settlement Ratio |

| ACKO Motor Own Damage | 99.10% for FY-2023-24 |

| ACKO Health Insurance | 98% for FY-2022-23 |

| Source: Acko Official Website |

Acko General Insurance reported a claim settlement ratio (CSR) of 99.10% for motor own damage claims in FY 2023-24, which is a very good thing.

The rejection ratio was 0.9%. Out of which 0.4 claims are rejected.

The remaining 0.5 claims are either pending due to a lack of mandatory documents from the customer or repair work is in progress.

Coverage Under HDFC Ergo Car Insurance:

Acko Car Insurance 2025 Review,

What is Covered?

Acko Car Insurance 2025 Review,

| Third-Party Losses | If your car causes damage to any third-party property/vehicle or life, such damage is covered by ACKO’s comprehensive car insurance policy. |

| Accidents | Damage to your car due to accidents/collisions is covered under ACKO car insurance. |

| Fire | Damage to your car caused due to accidental fire, vandalism, spontaneous ignition, etc. is covered by a comprehensive car policy. |

| Theft | Car theft is common in India and if your car gets stolen you may suffer huge financial losses. Acko’s Comprehensive Car Policy includes this coverage. |

| Calamities | Damage caused by both natural and man-made calamities is covered under a comprehensive car insurance policy. |

| Rat Bite Damages | Damage to your car due to rat bites can cost you a lot of money to repair. This is covered under our four-wheeler insurance policy. |

| Source: Acko official web |

What is Not Covered?

Acko Car Insurance 2025 Review,

| Pre-Existing Damages | Any damage caused to your car before you buy the policy from us will not be covered. |

| Normal Wear and Tear | Car insurance plans do not cover the repair or replacement cost of car parts that get damaged over time due to regular use. |

| Mechanical and Electrical Damage | Other types of manufacturing defects in the car components will not be covered under our comprehensive car insurance policy. |

| Driving Without Valid Documents | It is very important to have the necessary documents while driving. If you do not have such documents (current driving license, RC of the vehicle, etc.), then the damage caused to the car is not covered under the car insurance policy. |

| Illegal Driving | Driving your car in an illegal race, driving under the influence of alcohol, or being involved in any crime is considered illegal driving. ACKO car insurance plan does not cover car damages caused in such cases. |

| Loss Outside Geographical Limits | Any damage caused to the car while driving outside the geographical boundaries of India is not covered under car insurance. |

| Source: Acko official web |

How to Acko Car Insurance Online Claim Process?

Acko Car Insurance 2025 Review,

Here is a step-by-step overview of cashless car insurance.

Step 1: First of all, contact your insurance company either by calling them or sending an email. Nowadays almost all insurance companies have a dedicated section on their website/app to start the claim process, like Acko Login.

Step 2: Log in with the insurance company to inform them about the damage to the car.

Step 3: Then follow whatever they tell you. For example, in case of theft, you may be asked to file a First Information Report and submit other supporting documents.

Step 4: The surveyor may visit the accident spot for accident claims. Or the car will be taken to a garage (of your choice), and the surveyor will examine the damage there to see if what you are saying is real.

Step 5: The surveyor and mechanic will then discuss with you and inform you about the cost of repair and the amount covered by the policy depending on the coverage and terms and conditions.

Step 6: The car will be repaired and the bill will be shared between the garage and the car insurance company. And whatever balance amount (deductible) you will have to pay to the garage.

Note: In some cases, even the transportation of the vehicle to the garage and delivery of the repaired vehicle is done by the car insurance company.

Mandatory Documents while Registering for Car Insurance Claim:

Acko Car Insurance 2025 Review,

Note that the requirements may vary from one insurer to another.

- Car insurance policy.

- Driving licence.

- Registration certificate.

- First Information Report from the police (for accidents).

- Canceled cheque.

- Identity proof of the policyholder. For example, Aadhaar card details.

- Claim form.

Acko Car Insurance Customer Care Number?

Acko Car Insurance 2025 Review,

You can contact Acko customer service for car insurance through their toll-free numbers or email IDs from the insurance company.

Acko Car Insurance Contact Number?

Acko Contact Numbers (Toll-Free) & Support Email Address

| CAR/BIKE INSURANCE Email: hello@acko.com Call: 1800 266 2256(toll-free) |

How is Acko Car Insurance? and How is Acko Car Insurance Good?

Acko Car Insurance 2025 Review,

If we talk about how is the ACKO company, then there is no problem in taking insurance from the company.

“This company gives the claim quickly as per the customers, in some small cases, when the claim is made from the company, the company pays the claim amount in the policyholder’s account.

Then you can take that money and get your vehicle repaired from anywhere as per your wish like an authorized center or else.”

- Acko company also claims that their services are instant and they are also providing instant claims to you.

- If you make a video and send it to us, the company will instantly transfer the money to your account through it, the company claims this too.

- The company also provides you with the facility of pickup and drop, if your car is involved in an accident, the company will pick up your car, repair it, and then deliver it to you, the company also claims this.

- Acko Insurance offers low-cost premiums compared to other insurance companies. When you visit their website, you will find low premiums which is a great thing for insurance customers.

But we cannot trust any company blindly like this.

| Please Read Carefully the Best information before Buying ACKO Car Insurance : So the most important thing is that whenever we go to get our vehicle insured, we should go to our nearby service center where we get our vehicle serviced and find out from there whether the company whose insurance we are taking or any other company from which we are taking insurance is available there whether the cashless scheme is available or not. Or in the service center where you are getting your insurance done, discuss there that if we get your insurance done from ACKO insurance then what kind of service will we get or how has your experience with ACKO Because they know about this, they keep getting claims done, the service center people know which company is good. We cannot trust any company blindly, no matter which company it is, not ACKO it can be any company, so do check that Nearby is not cashless so first you will have to pay the money, then later your reimbursement comes and it can take some time there. |

Big Drowback Acko Car Insurance

Acko Car Insurance 2025 Review

| Please Read Carefully the Best information before Buying ACKO Car Insurance : Cashless Whenever the company is taking your vehicle for repair after picking it up after an accident, you must check whether the work being done by the company is an authorized center. If it is not authorized, then which are the authorized service centers? If their authorized service center is the same authorized service center that is authorized for your vehicle, then only you should get the work done from them. ACKO’s customers say that its service centers are not authorized. Their centers are not authorized. They may be authorized by them but yours can be authorized. But the companies whose vehicles you own, like Hyundai, Tata, and Toyota, are not authorized by those third-party service centers that have opened. We get the work done from them in the market as well. They don’t need to do a good job. The company Tie Ups because the company has to expand its service network. Keep in mind that the vehicle is yours and you need it. One has to always keep in mind that from where will the company get the claim done. If the company gets your claim done from its showroom or service center then you give the car to the company and let the company take it, there is no problem, they will take your car, get it repaired, and give it back to you but if your cashless account is not there and the company gives you to some outside service center, then you should strictly refuse them because the outside service center has no idea as to what part they should take out from your car and what quality of paint to use. So those things are not known, hence you must pay attention to these things. |