Welcome to our blog, friends. We are going to talk about Tata AIG car insurance.

What facilities does Tata AIG provide when you insure your car? What benefits does it provide? What features do you get with its policy?

So, friends, the Tata AIG committee is run by two groups. The first group is India’s Tata Group, and the second committee is the American Interselgroup. It is called AIG. Both groups work together for general insurance in India.

Why Choose Tata AIG Car Insurance? With Detailed Review of Online Vehicle Insurance

A Detailed Review of Online Vehicle Insurance,

Key Features of Tata AIG Car Insurance:

1. Cashless Garages

Friends, Tata AIG Car Insurance most Benefits is it has a network of 8700+ Cashless Garages in India. Like, whenever you are in a service center and take any of your vehicles there,

For Example, if your vehicle is a Hyundai or you take it anywhere in India, then in most cases, you will get Tata AIG Cashless Garages, and apart from that,

suppose you have a Mahindra, Toyota, Ford, etc. car. If you take it to any service center, you will get this in most cases.

And if you are traveling anywhere in all over India, then you can travel tension-free knowing that you have Tata AIG insurance. If there is an accident or any misshappening anywhere, then you can use it there.

And your claim gets done easily.

2. Renewals:

Friends, if your policy is running, then you can renew it continuously, but you have to renew it before the policy expires.

It is not like health insurance, if the policy expires today, you have a grace period of 1 month, so you will renew it 1 month after the policy expires.

Car insurance because there is the involvement of a third party in it.

That is why, if your car policy is going to expire tonight, then it has to be renewed before today. otherwise

If you renew it after today, then the company will inspect and take photos of the car and then renew it. So try,

that whenever you renew the car insurance, do it before the last day before the policy expires, or get the insurance policy done 1 week before the last day,

So that you do not have to face any problems later.

3. Zero DEP Policy:

The Zero Depreciation Policy is an add-on cover in the Tata AIG car insurance policy that helps you get the full claim amount for the replacement of your vehicle parts without considering depreciation.

How to buy Zero DEP Policy:

Covers depreciation: The (Zero DEP Policy) or Zero Depreciation Policy helps you get the full claim amount for replacing your vehicle parts without considering depreciation.

Eligibility: This policy is available only for vehicles up to 5 years old.

Claim limit: You can file only 2 claims under this policy.

Premium: You will have to pay a higher premium for this policy.

What is covered:

- Rubber, Nylon/Plastic Parts, Tyres, and Tubes covered: – 50% depreciation

- Fibre Glass Components: – 30% depreciation

- Glass Parts: – 5% depreciation in the first year and 10% in the second year

How to buy Zero DEP Policy:

1. Visit Tata AIG’s website.

2. Enter your vehicle details.

3. Select Zero Depreciation Policy for Buy Policy.

4. Pay the premium.

5. Receive the policy documents.

This policy provides more protection to your vehicle with helps you save money.

4. Motor Claim Settlement Ratio:

The motor claim settlement ratio of Tata AIG car insurance policy has been 99% in the financial year 2023-24.

This is a very good settlement ratio, which shows how seriously Tata AIG takes the claims of its customers.

This settlement ratio has been released by the Insurance Regulatory and Development Authority of India (IRDAI), and it shows how efficiently and effectively Tata AIG has settled the claims of its customers.

Apart from this, the claim process of Tata AIG is also very easy and convenient.

You can register your claim both online and offline, and the customer support team of Tata AIG is always ready to help you in every way.

5. Quick Claim Service:

Quick Claim Service Policy is a handy feature in Tata AIG car insurance policy. This policy helps you to quickly file a claim for the damage caused to your vehicle.

Key Details of Tata AIG Quick Claim Service Policy:

1. Quick Claim Settlement: Tata AIG Quick Claim Service Policy helps you to quickly file a claim for the damage caused to your vehicle.

2. Cashless Garages: You can get your vehicle repaired at any of Tata AIG’s 8700+ cashless garages.

3. 98% Claim Settlement Ratio: Tata AIG has a claim settlement ratio of 98%, which shows how seriously they take their customers’ claims.

4. Easy Claim Process: Tata AIG’s claim process is very easy. You can file your claim both online and offline.

This policy provides more protection for your vehicle and helps you save money.

6. Policy Cancellation Policy:

Policy Cancellation Policy is an important feature of Tata AIG car insurance policy. This policy allows you to cancel your policy if you feel that you no longer need insurance.

Key Details of Tata AIG Policy Cancellation Policy:

1. Cancellation Process: You can cancel your policy both online and offline.

2. Cancellation Fees: There is no fee for policy cancellation.

3. Refund Policy: If you cancel your policy, you get a proportionate refund.

4. Notice Period: You have to give a notice period of 7 days for policy cancellation.

5. Cancellation Reasons: You can cancel your policy for any reason, such as:

6. Policy is not needed

7. The vehicle has been sold

8. Vehicle registration has been canceled

Required Documents for Policy Cancellation:

1. Policy Document: Your original policy document

2. Cancellation Form: Cancellation form provided by Tata AIG

3. Vehicle Registration Certificate: Your vehicle’s registration certificate

4. ID Proof: Your ID proof, such as driving license or passport

This policy allows you to cancel your policy if you feel that you no longer need insurance.

Benefits of Tata AIG’s Online Vehicle Insurance:

Quick, Paperless Processes and Easy Policy Issuance:

Quick and Easy Policy Issuance is useful in Tata AIG car insurance policy. This policy provides you with instant digital policies, which require minimal paperwork.

Tata AIG Quick and Easy Policy Issuance Policy:

1. Instant Digital Policies: You are provided with instant digital policies.

2. Minimal Paperwork: This policy requires minimal paperwork.

3. Quick Issuance: Your policy is issued quickly.

4. Easy Application Process: The application process for your policy is very easy.

5. Digital Document Storage: Your documents are stored digitally.

Benefits of Tata AIG Quick and Easy Policy Issuance Policy:

1. Time-Saving: Your time is saved due to less paperwork.

2. Convenience: You are provided instant digital policies.

3. Environment-Friendly: There is no need for paper due to digital policies.

4. Easy Storage: Your documents are stored in digital form.

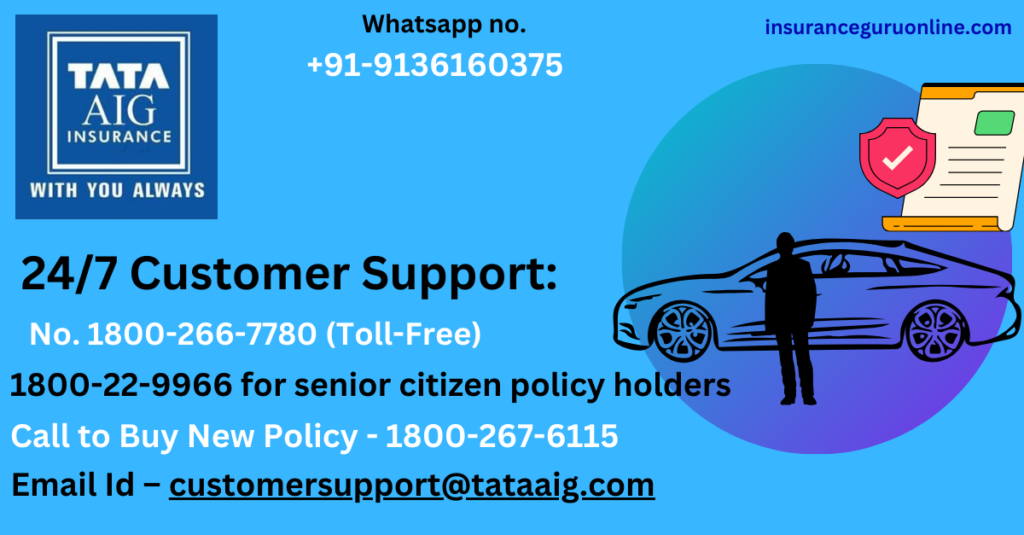

24/7 Customer Support A Dedicated helpline is a very useful feature in the Tata AIG car insurance policy:

Tata AIG’s 24/7 customer support provides instant assistance for claims and queries.

This dedicated helpline provides peace of mind, faster problem resolution, and convenience.

Customers can contact us for support any time of the day or night.

Key Details of Tata AIG 24/7 Customer Support Dedicated Helpline Policy:

1. 24/7 Customer Support:

You are provided with 24/7 Customer Support which ensures an Improved Customer Experience.

2. Dedicated Helpline:

You have a dedicated helpline number where you can call for help with your queries or issues. The dedicated Helpline number is:

1800 266 7780 (Toll-Free)

1800 22 9966 (only for senior citizen policy holders)

Whatsapp no. +91 9136160375

3. Quick Resolution:

Your queries or issues are resolved quickly. This gives you peace of mind as you know that help is always available for your queries or issues.

4. Multi-Language Support:

You are provided multi-language support, through which you can get help in the language of your choice.

5. Email Support:

You are also provided email support, through which you can get help for your queries or issues. Email Support for Tata AIG car insurance policy is:

customersupport@tataaig.com

You can mail to this email address for your queries or issues. Tata AIG’s customer support team will reply to your email and help you.

Eligibility for Tata AIG 24/7 Customer Support Dedicated helpline Policy:

1. Age: You must be above 18 years of age.

2. Vehicle: Your vehicle must not be older than 15 years.

3. Driving License: You must have a valid driving license.

4. Policyholder: You must be a policyholder of the Tata AIG car insurance policy.

Step-by-Step Guide to Tata AIG Car Insurance Renewal:

Importance of Renewing Your Car Insurance on Time:

Step-by-Step Guide to Tata AIG Car Insurance Renewal We read In Tata AIG car insurance policy, the importance of renewing your car insurance policy on time is very high. This policy tells you about the importance and benefits of renewing your car insurance policy.

Tata AIG Importance of Renewing Your Car Insurance on Time Policy:

1. Avoid Policy Lapse: By renewing your car insurance policy on time, you can avoid policy lapse.

2. Continuous Coverage: By renewing your car insurance policy, you get continuous coverage.

3. No Break in Coverage: By renewing your car insurance policy on time, you get no break in coverage.

4. Avoid Penalty: By renewing your car insurance policy on time, you can avoid penalties.

5. Maintain NCB: By renewing your car insurance policy, you can maintain your No Claim Bonus (NCB).

Benefits of Renewing Your Car Insurance on Time:

1. Financial Protection: By renewing your car insurance policy, you get financial protection.

2. Peace of Mind: By renewing your car insurance policy, you get peace of mind.

3. Compliance with Law: By renewing your car insurance policy, you can comply with the law.

4. Avoid Legal Issues: By renewing your car insurance policy on time, you can avoid legal issues.

There are some Benefits of Renewing Your Car Insurance on Time.

The outcome of not renewing your car insurance on time:

1. Policy Lapse: Not renewing your car insurance policy on time can lead to policy lapse.

2. Loss of NCB: Not renewing your car insurance policy on time can lead to you losing your No Claim Bonus (NCB).

3. Penalty: Not renewing your car insurance policy on time can lead to you paying a penalty.

4. Legal Issues: Not renewing your car insurance policy on time can lead to you facing legal issues

There are some outcomes of not renewing your car insurance on time condition.

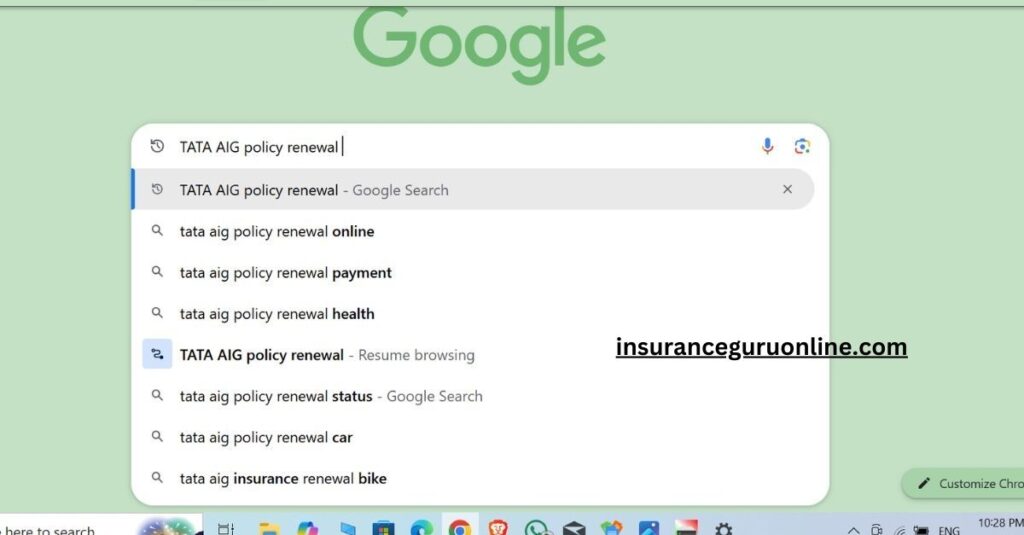

How to Renew Tata AIG Car Insurance Online:

The process of renewing your Tata AIG car insurance policy online is very easy. This policy helps you to renew your car insurance policy easily.

Step-by-Step Guide to Renew Tata AIG Car Insurance Online

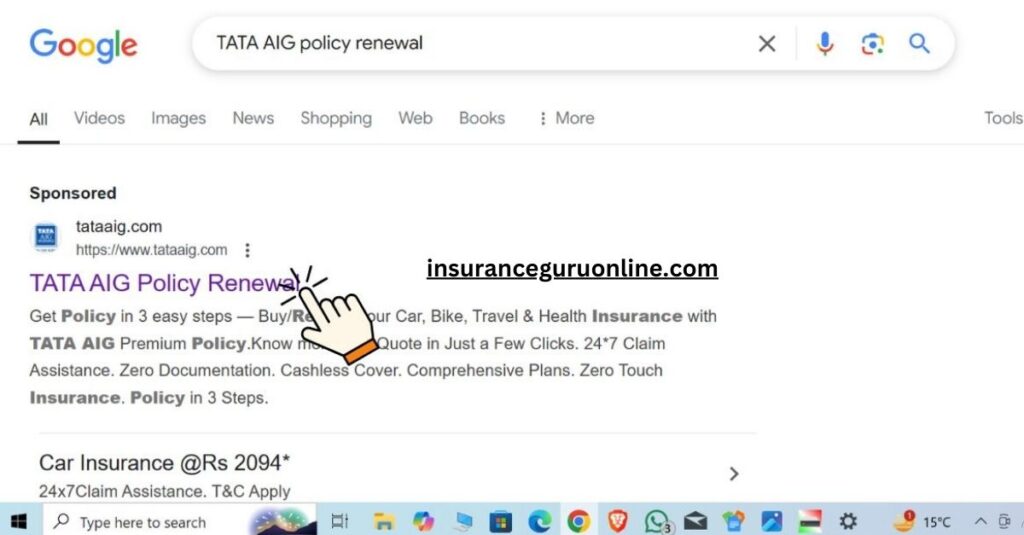

1. Go to Google and search for Tata AIG Policy Renewal.

2. Visit the official website of Tata AIG Policy Renewal.

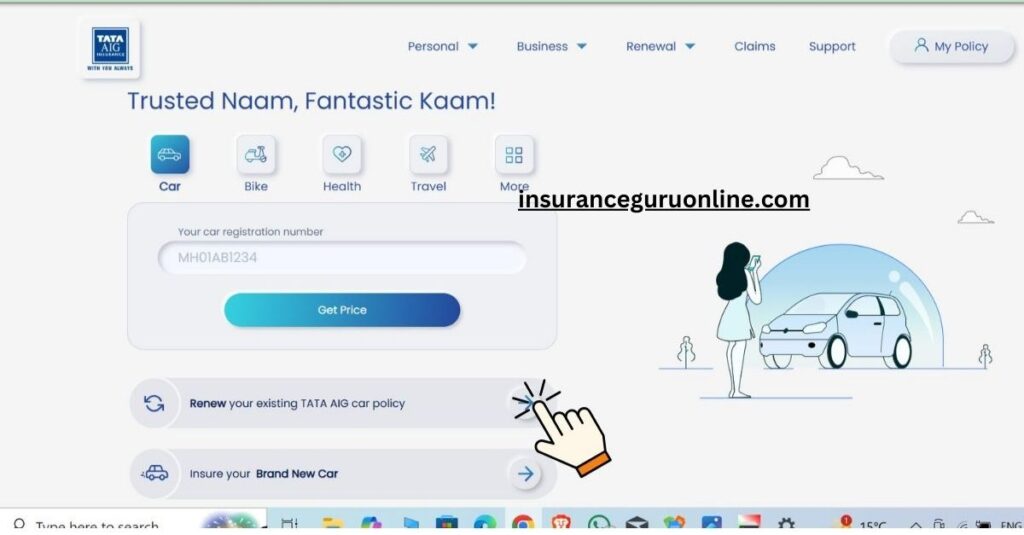

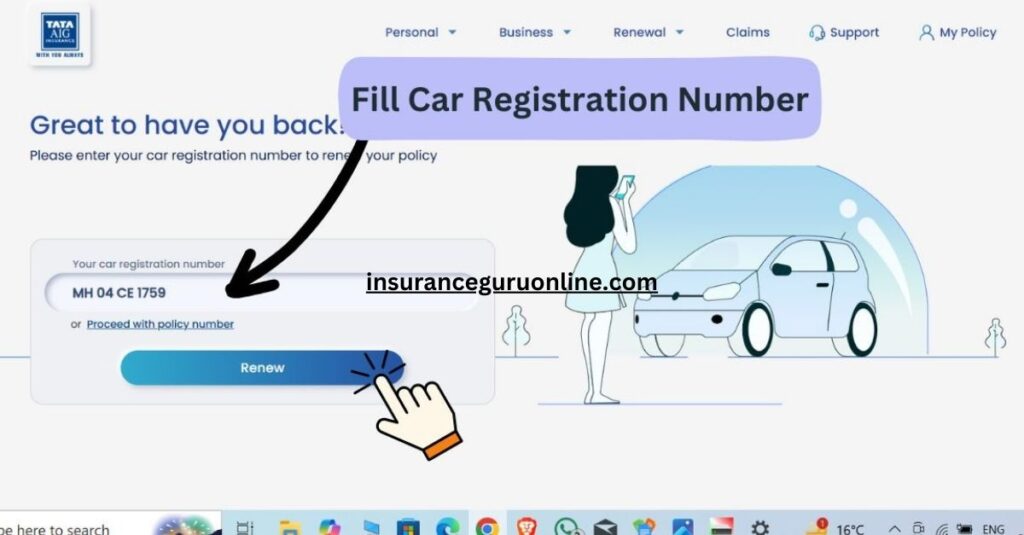

3. Go to the car section fill in your vehicle number and then click on renew.

4. Then enter the registered number.

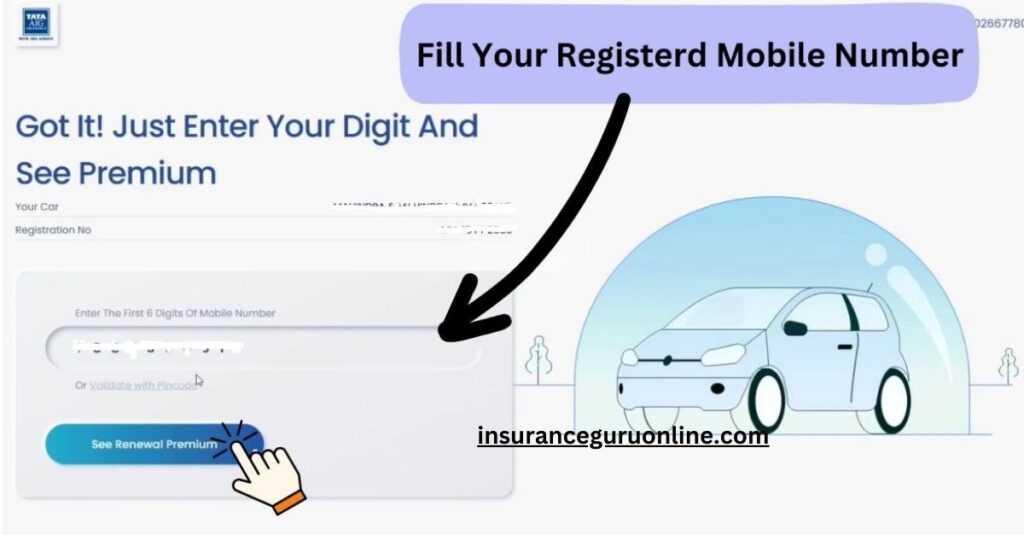

5. Then enter the registered mobile number and click on see renewal premium.

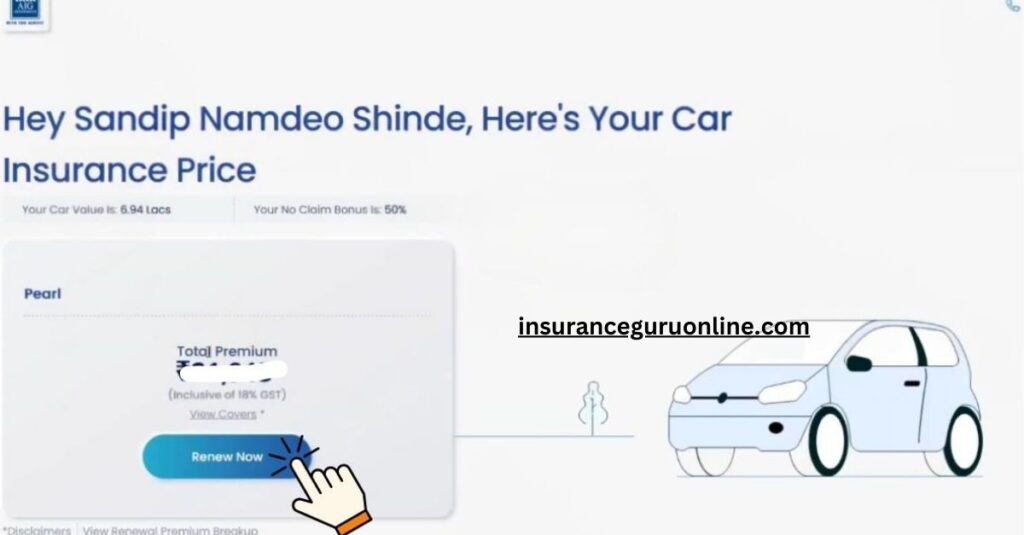

6. Then the premium will be visible and then you have to click on Renew Now.

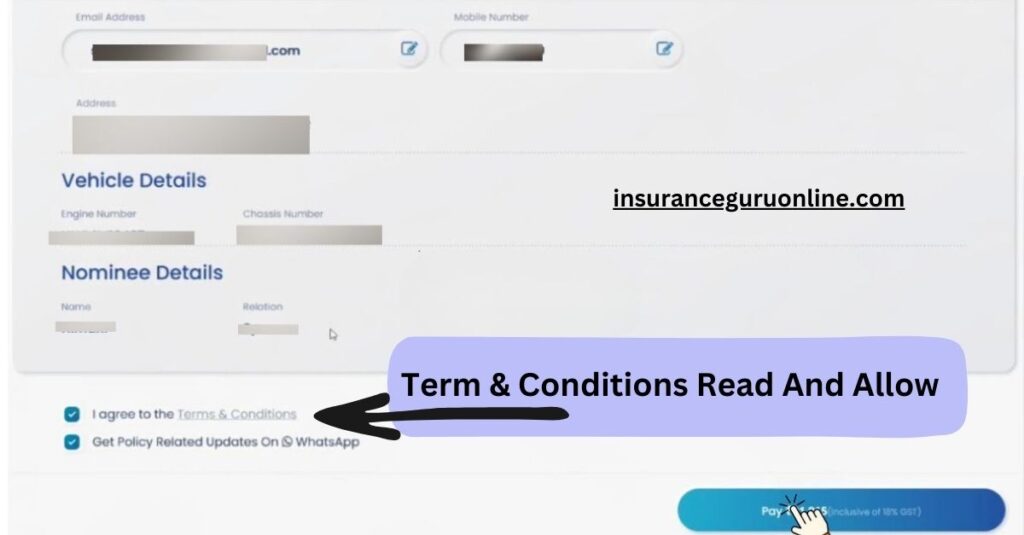

7. Then your details will be shown to you. Then you have to read the terms and conditions click on the terms and conditions check box and then click on pay now.

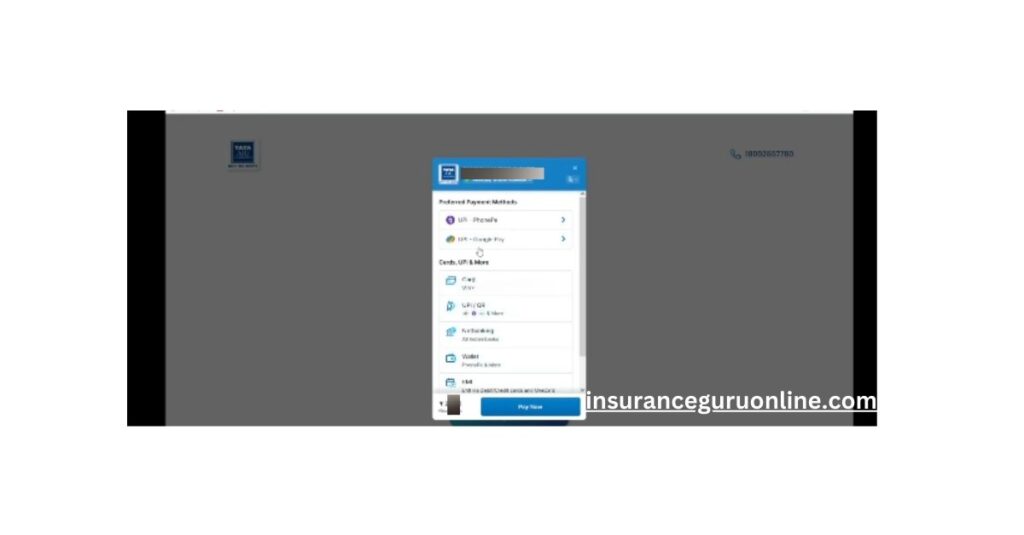

8. Then you will be shown many payment options.

Payment Options: You will have online payment options, such as credit/debit cards, net banking, etc.

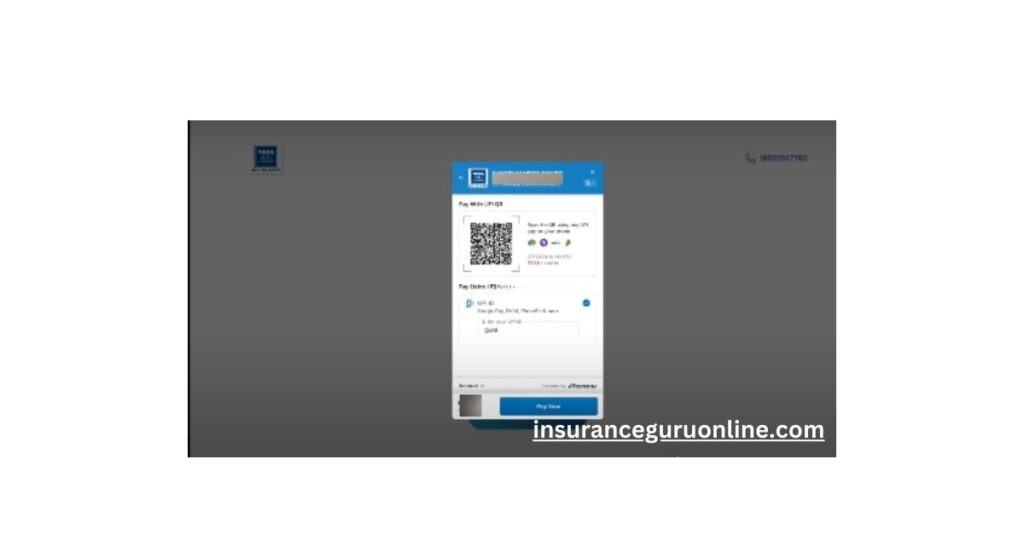

9. Then you can make the payment using UPI, QR or any other payment option.

10. Then Payment Confirmation: Your payment will be confirmed.

This is a very easy process.

Benefits of Renewing Tata AIG Car Insurance Online:

1. Easy Renewal Process: Your policy renewal process is very easy.

2. Time-Saving: Your time is saved as you can renew online.

3. Convenience: You get the facility of renewing your policy.

4. Secure Payment: Your payment is made securely.

Tips to Save on Car Insurance Renewal:

You can save on your premium by following some tips while renewing your car insurance policy. This policy tells you about the tips and benefits of renewing your car insurance policy.

Tips to Save on Car Insurance Renewal Policy

1. Compare Premium Rates: Compare the premium rates of different insurance companies and renew the policy at the lowest premium rate.

2. No Claim Bonus (NCB): If you have not made any claim in the previous year, then you can get NCB, due to which you can save on your premium.

3. Voluntary Deductible: You can save on your premium by choosing a voluntary deductible.

4. Add-On Covers(Zero DEP Policy): Choose only those add-on covers that are necessary for you.

5. Low-Value Car: If you have a low-value car, you can choose a third-party insurance policy.

6. Install Anti-Theft Devices: You can save on your premium by installing anti-theft devices.

7. Maintain a Good Driving Record: If you have a good driving record, your policy can be renewed at a lower premium rate.

Benefits of Saving on Car Insurance Renewal

1. Reduced Premium: You can save on your premium.

2. Increased Savings: You can have more savings.

3. Better Financial Planning: You can improve your financial planning.

# Eligibility for Saving on Car Insurance Renewal

1. Age: Your age should be more than 18 years.

2. Vehicle: Your vehicle should not be older than 15 years.

3. Driving License: You should have a valid driving license.

4. Existing Policy: You should have an Existing Policy, for example, if you have taken a Tata AIG car insurance policy, then you should have a Tata AIG car insurance policy.

Understanding the Tata AIG Claims Process

There are two types of claims in Tata AIG car insurance policy:

Cashless and Reimbursement. This policy tells you about both types of claims.

Understanding the Tata AIG Claims Process and Types of Claims: Cashless vs. Reimbursement

1. Cashless Claims

1. Cashless Facility: Cashless facility is available in Tata AIG’s network garages.

2. No Out-of-Pocket Expenses: You do not have to pay any out-of-pocket expenses.

3. Tata AIG Settlement: Tata AIG settles directly with the garage.

Key Benefits of Cashless Claims

1. Convenience: The process of cashless claims is very easy.

2. No Financial Burden: You do not have any financial burden.

3. Quick Settlement: The settlement process is quick.

2. Reimbursement Claims

1. Reimbursement Facility: You have to make the first payment for the repair of your vehicle.

2. Claim Form: You have to fill out the claim form and submit documents.

3. Reimbursement: Tata AIG reimburses you.

Key Benefits of Reimbursement Claims

1. Flexibility: You get the flexibility to choose any garage for your vehicle repair.

2. Control Over Repairs: You get control over the repair of your vehicle.

3. Reimbursement: You get reimbursement.

# Documents Required for Claims

1. Claim Form: Claim form has to be filled.

2. Policy Document: A copy of the Policy document has to be submitted.

3. Vehicle Registration Certificate: A copy of the Vehicle registration certificate has to be submitted.

4. Driving License: A copy of Driving license has to be submitted.

5. Repair Estimate: A copy of the Repair estimate has to be submitted.

# Eligibility for Claims

1. Age: Your age should be more than 18 years.

2. Vehicle: Your vehicle should not be older than 15 years.

3. Driving License: You should have a valid driving license.

4. Existing Policy: You should have a Tata AIG car insurance policy.

How to File a Claim with Tata AIG

The process of filing a claim in Tata AIG car insurance policy is very easy. This policy provides you with a step-by-step guide to filing a Claim with Tata AIG.

Notify Tata AIG Immediately

1. Notify Tata AIG: Immediately notify Tata AIG of the claim.

2. Call Tata AIG: Call Tata AIG’s customer care number.

3. Email Tata AIG: Email Tata AIG’s email address.

Submit Required Documents

Submit Required Documents

1. Claim Form: Fill out the claim form and submit it.

2. Policy Document: Submit a copy of the policy document.

3. Vehicle Registration Certificate: Submit a copy of the vehicle registration certificate.

4. Driving License: Submit a copy of the driving license.

5. Repair Estimate: Submit a copy of the repair estimate.

Vehicle Inspection and Claim Settlement

1. Vehicle Inspection: Tata AIG surveyors will inspect your vehicle.

2. Claim Settlement: The process of claim settlement will begin.

3. Payment: The payment of the claim amount will be transferred to your account.

Key Benefits of Filing a Claim with Tata AIG

1. Easy Claim Process: The process of filing a claim is very easy.

2. Quick Settlement: The process of claim settlement is quick.

3. Transparent Process: The claim process is transparent.

Documents Required for Claim Settlement

1. Claim Form: You have to fill out the claim form.

2. Policy Document: A copy of the Policy document has to be submitted.

3. Vehicle Registration Certificate: A copy of the Vehicle registration certificate has to be submitted.

4. Driving License: A copy of the Driving license has to be submitted.

5. Repair Estimate: A copy of the Repair Estimate has to be submitted.

Eligibility for Claim Settlement

1. Age: Your age should be more than 18 years.

2. Vehicle: Your vehicle should not be older than 15 years.

3. Driving License: You should have a valid driving license.

4. Existing Policy: You should have a Tata AIG car insurance policy.

Common Reasons for Claim Rejections

There can be many reasons for claim rejection in Tata AIG car insurance policy. This policy tells you about the most common reasons for claim rejection.

1. Incomplete or Incorrect Documentation: If you have given wrong or incomplete information in your claim form or other documents, then your claim may be rejected.

2. Lack of Policy Coverage: If the loss claimed under your policy is not covered, then your claim may be rejected.

3. Lack of Driving License or Registration Certificate: If you do not have a valid driving license or registration certificate, then your claim may be rejected.

4. Lack of vehicle maintenance: If you have not maintained your vehicle, then your claim may be rejected.

5. Not reporting the accident: If you have not reported the accident to the police, then your claim may be rejected.

6. Missing the claim deadline: If you have missed the claim deadline, then your claim may be rejected.

7. Violation of the terms and conditions of the policy: If you have violated the terms and conditions of the policy, then your claim may be rejected.

Key Tips to Avoid Claim Rejections

1. Firstly Key Tips to Avoid Claim Rejections Read the terms and conditions of the policy: Read and understand the terms and conditions of the policy.

2. Fill the claim form correctly: Fill the claim form correctly and attach the necessary documents.

3. Maintain the vehicle: Maintain the vehicle and keep records.

4. Give the accident report to the police: Give the accident report to the police and keep a copy.

5. Do not miss the claim deadline: Do not miss the claim deadline and file the claim on time.

Eligibility for Claim Settlement:

1. Age: Your age should be more than 18 years.

2. Vehicle: Your vehicle should not be older than 15 years.

3. Driving License: You should have a valid driving license.

4. Existing Policy: You should have a Tata AIG car insurance policy.

Conclusion:

Tata AIG car insurance policy is a reliable and affordable option that keeps your vehicle safe and secure. After understanding the advantages and disadvantages of this policy, you can easily decide whether this policy is right for you or not.

Benefits of Tata AIG Car Insurance

1. Ease of Online Processes: It is very easy to buy and renew your Tata AIG car insurance policy online.

2. Customer-Centric Approach: Tata AIG’s customer support team is very helpful and responds on time.

3. Comprehensive Coverage Options: Tata AIG car insurance policy offers comprehensive coverage options that keep your vehicle completely safe.

4. Cashless Garage Facility: With Tata AIG’s cashless garage facility, you do not have to pay any out-of-pocket expenses for the repair of your vehicle.

5. Efficient Claim Settlement: The claim settlement process in Tata AIG car insurance policy is very fast and easy.

Drawbacks of Tata AIG Car Insurance

1. Technical Glitches: Some customers have experienced technical glitches when they try to buy or renew the policy online.

2. Delayed Claim Settlement: Some customers have experienced delays in claim settlement.

3. Limited Add-on Covers: The options of add-on covers are limited in the Tata AIG car insurance policy.

But Technical Glitches This is rare and happens with some people

but I checked their website and their interface is spotless if you visit them then you also have a good rating of 4.4 present time. And

I went to the app and looked for car insurance and the reviews are good. But,

Additional Advice:

I would like to give additional advice that you can check the reviews of the car insurance local head office of your nearby area and

this will make it easier to get car insurance and you will get to know less about the problems.

Look, bad reviews are there everywhere but you have to judge what type of service is being provided to the customers in your area, in your city.

TATA AIG Insurance App review:

I checked their website and their interface is spotless if you visit them then you also have a good rating of 4.4 at present time.

I went to the app and looked for car insurance and the TATA AIG Car Insurance reviews are good.

Tata AIG Car Insurance the Right Choice for You?

1. Assess Your Needs: Understand your need for the safety of your vehicle.

2. Compare Policies: Compare the policies of different insurance companies.

3. Read Reviews: Read Tata AIG car insurance policy reviews and look at customer ratings.

When the drawbacks of Tata AIG vehicle insurance policy are compared with other car insurance policies, it becomes clear that every policy has its advantages and disadvantages.

You should choose the policy as per your needs and budget.

If you like the benefits and options given in the Tata AIG car insurance policy, then this policy is right for you. Check out the latest insurance information and other best insurance pieces of information.